Medical Plans

You have options when it comes to your medical and pharmacy benefits—each with different levels of coverage to fit your life.

The ECU Health Medical Plan is administered by Medcost. If you need to request an ID card, print or view an explanation of benefits (EOB) or find a provider, visit medcost.com. The ECU Health group number for MedCost is 7488.

Often-used terms

Before you review your medical plan options, you may want to get familiar with these terms:

- Coinsurance: A set percentage you pay of the cost of the care you receive.

- Copay: A set dollar amount you pay when you receive health care. For example, $35 when you see a specialist.

- Deductible: A set amount you must pay out of your pocket before the plan starts paying part of the cost, unless a copay applies. All deductible payments contribute to a plan’s annual out-of-pocket maximum.

- Out-of-pocket maximum (OOP max): The most you will pay in a calendar year for provider visits, prescriptions, etc., for covered expenses, including your deductible, copays and coinsurance. This safety net provides peace of mind for those who have a serious condition or illness. Family medical plans have single and family out-of-pocket maximums. Once a covered family member meets the individual out-of-pocket maximum, the plan will pay the full cost of covered charges for that family member. Charges for all covered family members will continue to count toward the family out-of-pocket maximum.

Comparing the 2024 Options

ECU HealthNow

You can use ECU HealthNow to connect with a provider 24/7 by phone or online. If you are enrolled in the Medical Savings Plan, there is a $55 fee for service until your deductible has been met.

Visit ECU HealthNow or download the ECU HealthNow app from your app store.

| Tier 1 ECU Health Alliance/In-Network |

Tier 2 MedCost/In-Network |

Tier 3 Out-of-Network |

|

|---|---|---|---|

| Preventive | Covered at 100% | Covered at 100% | Plan pays 50%, you pay 50% |

| Plan Coinsurance | Ded., then 15% coins. | Ded., then 25% coins. | Ded., then 50% coins. |

| Primary Care Physician Visit | Ded., then 5% coins. | Ded., then 5% coins. | Ded., then 50% coins. |

| Specialty Visit | Ded., then 10% coins. | Ded., then 25% coins. | Ded., then 50% coins. |

| Behavioral Health Office Visit | Ded., then 5% coins. | Ded., then 5% coins. | Ded., then 50% coins. |

| ECU HealthNow | Ded., then $0 | Ded., then $0 | Ded., then $0 |

| Med Deductible (Single/Family) | $2,000/$4,000 | $2,500/$5,000 | $6,000/$12,000 |

| Med Max OOP (Single/Family) | $6,000/$12,000 | $6,750/$13,500 | $12,500/$25,000 |

| Prescription Max OOP (Single/Family) | Included in medical OOP max | Included in OOP max | Included in OOP max |

| Combined OOP Max (Med + Rx) | $6,000/$12,000 | $6,750/$13,500 | $12,500/$25,000 |

| Emergency Room | Ded., then 15% coins. | Tier 1 ded., then 15% coins.* | Tier 1 ded., then 15% coins.* |

| Urgent Care | Ded., then 15% coins. | Ded., then 25% coins. | Ded., then 50% coins. |

| Inpatient/Outpatient Hospital | Ded., then 15% coins. | Ded., then 25% coins. | Ded., then 50% coins. |

* For these services, you first pay the Tier 1 deductible. Once the Tier 1 deductible is met, you will then pay only the coinsurance.

| Tier 1 ECU Health Alliance/In-Network |

Tier 2 MedCost/In-Network |

Tier 3 Out-of-Network |

|

|---|---|---|---|

| Preventive | Covered at 100% | Covered at 100% | Ded., then 50% coins. |

| Plan Coinsurance | Plan pays 85%, you pay 15% | Plan pays 75%, you pay 25% | Plan pays 50%, you pay 50% |

| PCP Visit | $10 copay | $10 copay | Ded., then 50% coins. |

| Specialty Visit | $25 copay | $60 copay | Ded., then 50% coins. |

| Behavioral Health Office Visit | $10 copay | $10 copay | Ded., then 50% coins. |

| ECU HealthNow | Covered at 100% | Covered at 100% | Covered at 100% |

| Deductible (Single/Family) | $1,200/$2,400 | $1,500/$3,000 | $4,500/$9,000 |

| Med Max OOP (Single/Family) | $4,000/$8,000 | $5,000/$10,000 | $10,000/$20,000 |

| Rx Max OOP (Single/Family) | $2,500/$5,000 | $2,500/$5,000 | $2,500/$5,000 |

| OOP Max (Med + Rx) | $6,500/$13,000 | $7,500/$15,000 | $12,500/$25,000 |

| Emergency Room | $250 copay + ded./15% coins. | $250 copay + Tier 1 ded./15% coins. * | $250 copay + Tier 1 ded./15% coins. * |

| Urgent Care | $50 copay | $60 copay | Ded., then 50% coins. |

| In/Outpatient Hospital | Ded., then 15% coins. | Ded., then 25% coins. | Ded., then 50% coins. |

* For these services, you first pay the Tier 1 deductible, and then coinsurance.

| Tier 1 ECU Health Alliance/In-Network |

Tier 2 MedCost/In-Network |

Tier 3 Out-of-Network |

|

|---|---|---|---|

| Preventive | Covered at 100% | Covered at 100% | Ded., then 50% coins. |

| Plan Coinsurance | Plan pays 85%, you pay 15% | Plan pays 75%, you pay 25% | Plan pays 50%, you pay 50% |

| PCP Visit | $10 copay | $10 copay | Ded., then 50% coins. |

| Specialty Visit | $15 copay | $50 copay | Ded., then 50% coins. |

| Behavioral Health Office Visit | $10 copay | $10 copay | Ded., then 50% coins. |

| ECU HealthNow | Covered at 100% | Covered at 100% | Covered at 100% |

| Deductible (Single/Family) | $850/$1,700 | $1,250/$2,500 | $3,500/$7,000 |

| Med Max OOP (Single/Family) | $3,300/$6,600 | $4,500/$9,000 | $8,000/$16,000 |

| Rx Max OOP (Single/Family) | $2,500/$5,000 | $2,500/$5,000 | $2,500/$5,000 |

| OOP Max (Med + Rx) | $5,800/$11,600 | $7,000/$14,000 | $10,500/$21,000 |

| Emergency Room | $200 copay + ded./15% coins. | $200 copay + Tier 1 ded./15% coins. * | $200 copay + Tier 1 ded./15% coins. * |

| Urgent Care | $40 copay | $50 copay | Ded., then 50% coins. |

| In/Outpatient Hospital | Ded., then 15% coins. | Ded., then 25% coins. | Ded., then 50% coins. |

* For these services, you first pay the Tier 1 deductible, and then coinsurance.

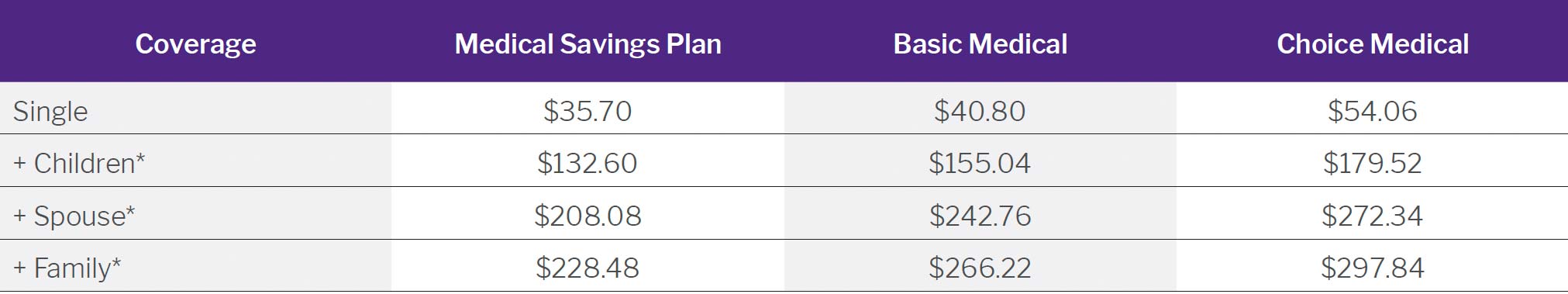

2024 Premiums

Full-Time Team Members—Bi-Weekly Deductions

* Includes domestic partner/domestic partner’s children.

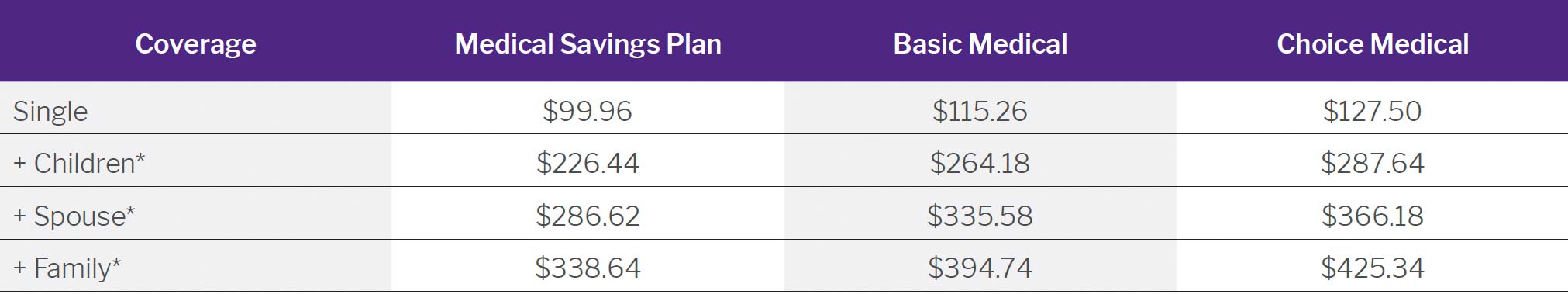

Part-Time Team Members—Bi-Weekly Deductions

* Includes domestic partner/domestic partner’s children.