2025 Annual Enrollment

OCT. 28 – NOV. 15

Learn about your 2025 benefits

While you provide excellent care for patients every day, ECU Health provides you with a comprehensive Total Rewards package comprising a suite of benefits selected for you and your family. Make the most of your 2025 benefits by selecting the coverage that best fits your needs during Annual Enrollment.

Transition from MedCost to Allegiance

Effective Jan. 1, 2025, Allegiance will be ECU Health’s medical plan administrator and medical claims processor.

What you need to know about this change

- Allegiance (a Cigna Company) will replace MedCost as our medical plan administrator and claims processor

- Allegiance offers a larger, nationwide network of providers and specialists – OAP (Open Access Plus)

- With this change, ECU Health will receive an enhanced claims processing experience with deeper upfront discounts on health care services

- The approval/denial decision process for prior authorizations are based on Allegiance’s definition of medical necessity, which may differ from MedCost

- ECU Health will have a local Allegiance representative dedicated to ECU Health team members to help you navigate transition of care concerns and answer questions

- Allegiance will mail new medical plan ID cards to your mailing address. Do not throw away or disregard any materials you receive from Allegiance. You will need to present your new medical ID card at any pharmacy or health care provider

- View the ECU Health customized provider network directory website at askallegiance.com/ecuhealth

- More than 97% of current Tier 2 providers and specialists are in the Allegiance network, with approximately an additional 1,300 to be added as in-network providers with the change to Allegiance effective Jan. 1, 2025

Why is ECU Health changing to Allegiance?

- To expand our network and number of providers, both locally and nationally

- To enhance the claims processing experience for our team members

- To provide billing statements more quickly to our team members

- To add more convenience with a robust mobile app and website that will make access easier as well as provide insight to benefit plan options and providers

- To offer team members convenient resources for learning and understanding benefits

- To offer a deeper upfront discount on health care services for the Medical Plan

- Allegiance Welcome Packet

ECU Health Benefit Deductions

The amount you pay for your ECU Health benefits will now come out of 24 paychecks (instead of 26) beginning in 2025. This change simplifies administration and aligns with best practices.

What to expect:

- You will still be paid biweekly with 26 pay periods per year

- Benefit deductions will increase per pay period due to annual amounts being divided by 24 versus 26. The annual amount you pay in benefit deductions stays the same

- Moving from 26 to 24 deductions will impact spousal surcharge amount which will be $55 biweekly for 2025

- For two pay periods (the months with three paychecks), no benefit deductions will be applied to your paycheck

- Includes benefits such as medical, dental, vision, spousal premium, FSA, HSA, life, disability, critical illness, hospital indemnity, accident, legal and identity theft

- Excludes any retirement savings contributions, such as 401(k)

HSA Employer Contributions

For 2025, ECU Health will be contributing $600 for individual coverage and $1,200 for family coverage to Health Savings Account participants. This year’s contributions will be distributed evenly in quarterly increments ($150 per quarter for individual coverage and $300 per quarter for family coverage). Click here to view the HSA Contribution Schedule.

PTO Accrual Changes

The PTO annual maximum carry-over of 400 hours is transitioning to a per pay-period (biweekly) accrual cap. This change aligns with industry standards and incentivizes team members to take their well-earned time off to avoid burn out and to build in time throughout the year for their own health and well-being.

- Currently, the PTO policy has a maximum carryover of 400 hours at the end of the calendar year. If not cashed out or donated, team members forfeit PTO hours above 400.

- ECU Health is implementing the biweekly cap in phases to help team members adjust to the policy change. Next year (2025) will be a transition year, where the biweekly cap will be 500 hours.

- Tip: Use the transition year (2025) to track your PTO balance, proactively manage your time and request/schedule your time off in advance so you avoid not accruing

- In 2026, there will be a 400-hour PTO cap per pay period

Reminders for PTO cash out:

- Maximum of 80 hours can be cashed out per calendar year

- If you ‘opt-in’ to cash out hours during the election period (Annual Enrollment timeframe), your hours will be paid out at 100%

- If you did not ‘opt-in’ to cash out hours during the election period, your hours will be paid out at 90%

2025 Benefits Guides

Take time to review the 2025 guide so you make smart benefit decisions.

Other Resources to Help You Learn About Your Benefits

Questions? AskPhin!

Visit AskPhin.com or call 252‑816‑PHIN (7446).

Virtual Benefits Fair Oct. 21-25

Visit the Virtual Benefits Fair webpage for more information.

Annual Enrollment Education Week

Participate in Annual Enrollment Education Week Oct. 21 – 25 to learn more about what’s changing in 2025. Three ways you can participate in this important week of benefits education opportunities:

The Virtual Benefits Fair – Oct. 21 – 25

Annual Enrollment Virtual Office Hours – Oct. 21 – 25

The Total Rewards team is ready to answer your benefits questions during Annual Enrollment office hours. Join us.

- Monday, Oct. 21 – Noon Join the meeting now Meeting ID: 242 998 266 59 Passcode: Ltfgi7

- Wednesday, Oct. 23 – 2 p.m. Join the meeting now Meeting ID: 228 735 515 650 Passcode: 5nnSCC

- Friday, Oct. 25 – Noon Noon Join the meeting now Meeting ID: 256 439 366 001 Passcode: VTohDj

In-person education sessions

Watch for information about in-person benefits meetings at your location. In the meantime, check out this list of 2025 Annual Enrollment Roadshows and mark your calendars to attend one.

Your 2025 Annual Enrollment Checklist

Visit allin.ecuhealth.org to view the 2025 Benefits Guide and 2025 premiums

Review your anticipated health care spending to estimate how much you may want to contribute to an FSA or HSA in 2025. You must be enrolled in the Medical Savings Plan to participate in the HSA. You must re-enroll in the HSA and FSAs to continue these benefits in 2025

Gather information before you enroll (e.g., your Employee Self Service password, Social Security number(s), address(es), birthdate(s) of covered dependents or beneficiaries, etc.)

Enroll and make changes during the Annual Enrollment period — Oct. 28 – Nov. 15, 2024

- Go to myhr.ECUHealth.org

- Enter your user ID (employee ID number) and password

- Select the Benefits Enrollment tile

- Enter your ECU Health email address and Employee Self Service password

- Elect or waive each benefit via bswift

- Double-check your elections to ensure you have the best coverage for you and your family in 2025

Ensure your mailing address is listed correctly in Employee Self Service

Watch your mailing address for your new Allegiance medical ID cards

File your 2024 Wellness Claim. If you are enrolled in the Voya voluntary benefits, you may be eligible to receive a $75 wellness benefit per insured member per policy

Have you filed your Wellness Claim for 2024?

Don’t miss out on this $75 benefit if you’re insured in any Voya plan. You and your insured family members can each earn the benefit for each policy you have.

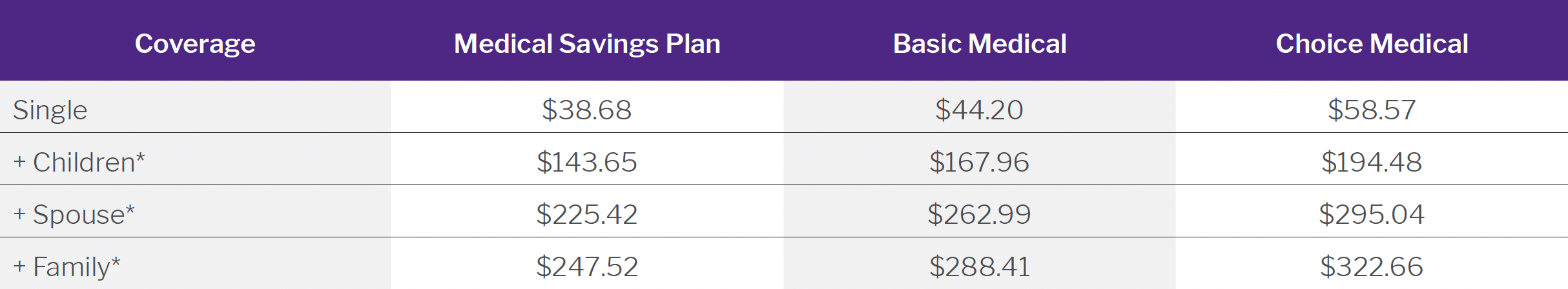

2025 Premiums

Full-time team members — 24 Biweekly deductions

* Includes domestic partner/domestic partner’s children.

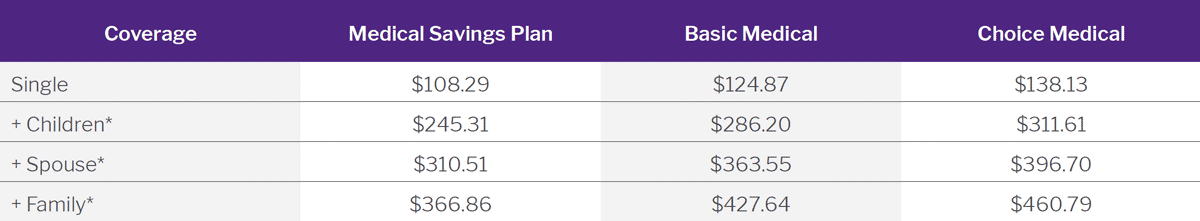

Part-time team members — 24 Biweekly deductions

* Includes domestic partner/domestic partner’s children.